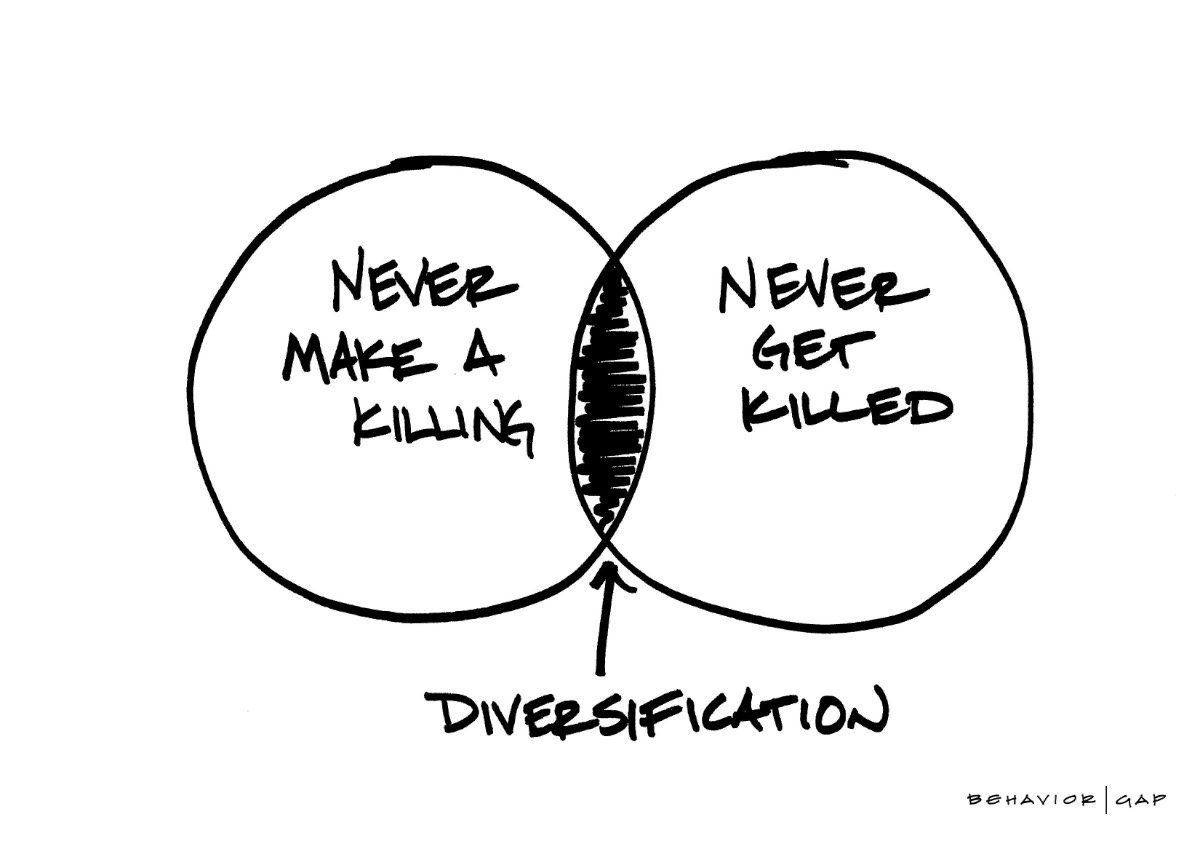

Never make a killing, never get killed

One idea that we talk to many of our clients about at Financial Edge Group is that our aim is to ‘never make a killing, but never get killed’.

Wondering what on earth that means? This concept is all about diversification – we want you to have enough diversification in your financial strategy that you’re seeing good results in your investments year on year, but not taking so many risks that you get wiped out.

You might hear that a friend has bought some stock that’s doubled in price overnight and think ‘I wish we had bought that stock!’. Maybe your friend has made the right decision, but maybe that same stock will halve in price in a month, or even worse, the company may go bankrupt.

A similar sentiment we have heard in recent years is ‘I wish we had bought Bitcoin before it doubled in price! We could have made a killing!’. Yes, you could have! But Bitcoin is one of the most volatile investments in the market, and we’ve seen its value go both up and down – so although it has high value one minute, it could just as easily lose its value the next.

Our focus is not only to create wealth but also to protect the wealth you’ve got. We want to find a steady return that will maintain your investments now and in the future and protect your wealth as much as we can from risky decisions.

So while you may not always make a killing, we feel it’s more important to focus on never getting killed – never being in a position where you could lose all of your investments, assets and future security.

We never want you to have sleepless nights worrying about what ‘could’ happen, which is why we take a client-first approach in everything we do. If you’re looking for an adviser you can be confident will put you first, let’s have a chat!